discover — Middle of Funnel

B2B buyers don’t browse—they hunt. When your site search can’t surface the exact product fast, they leave and buy elsewhere. We build AI-powered internal search engines that understand buyer intent, trained on your catalog and fully managed—so the right SKU shows up instantly.

68%

of B2B buyers abandon sites after failed searches

12%

average conversion rate lift with AI-powered site search

43%

of search queries contain typos, jargon, or competitor SKUs

You paid for a search solution. It came with the platform. Or maybe you bolted on Algolia, SearchSpring, or something similar. Either way, it's not working. Here's why.

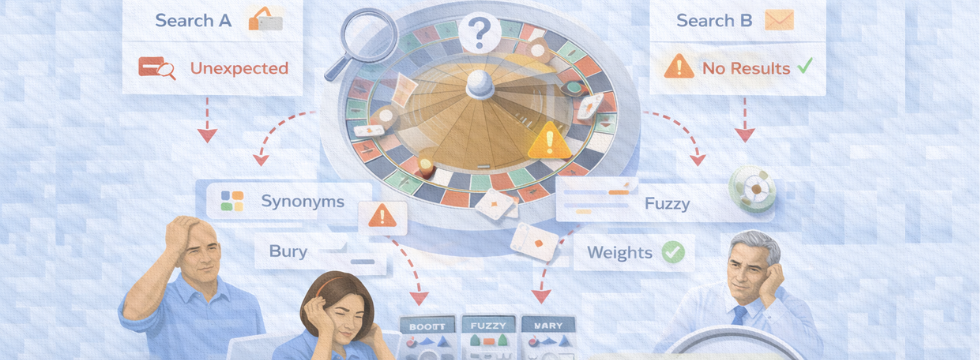

Every site search platform comes with knobs and dials: boost this field, bury that category, add synonyms, adjust fuzzy matching. The promise is control. The reality is chaos.

Your team tweaks a setting to fix one search result. Three weeks later, someone notices a completely different product category is now broken. Nobody knows which change caused it. Nobody has time to figure it out. So the setting stays, the results stay bad, and buyers keep leaving.

This isn't a staffing problem. It's a fundamental design flaw. Traditional search engines are keyword-matching machines that require constant human intervention to produce sensible results. Every "improvement" introduces new edge cases. The more you tune, the more fragile it becomes.

Most companies eventually give up. They leave the search at default settings and hope for the best. Their buyers pay the price.

Problem #1

Your buyers don't speak in your catalog's language. They search for "coverslips" when you call them "cover glass." They type "THC test" when your system needs "marijuana drug screen." They paste "McKesson #12345" expecting you to know what that means.

Traditional search engines are literal. They match keywords. When the buyer's vocabulary doesn't match your product titles and descriptions, they get irrelevant results or—worse—nothing at all.

The fix most platforms offer? Manual synonym lists. Build a spreadsheet of every possible term variation. Keep it updated as your catalog changes. Hope you don't miss any

Nobody does this well. Nobody has time to do this well. So buyers keep searching in their language and getting results in yours—which is to say, no results at all.

Problem #2

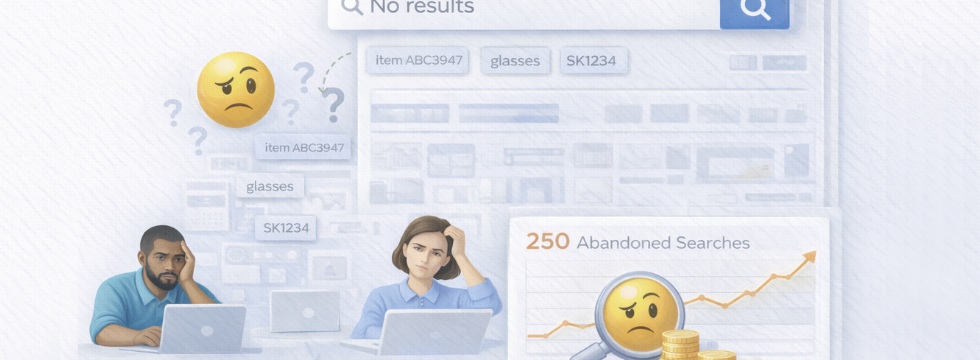

Watch your analytics. Look at the searches that return zero results. Look at the searches where users immediately leave or start over with different terms. Look at the searches that return results but no clicks.

These are buyers who came to your site with intent to purchase and left empty-handed—not because you didn't have what they needed, but because your search couldn't connect their query to your inventory.

Every abandoned search is stolen revenue. Not lost—stolen. By the competitor whose site returned the right result on the first try.

Now look at how many abandoned searches you have per day. Per month. That's the cost of your current internal search engine. You're paying for it whether you see the invoice or not.

Problem #3

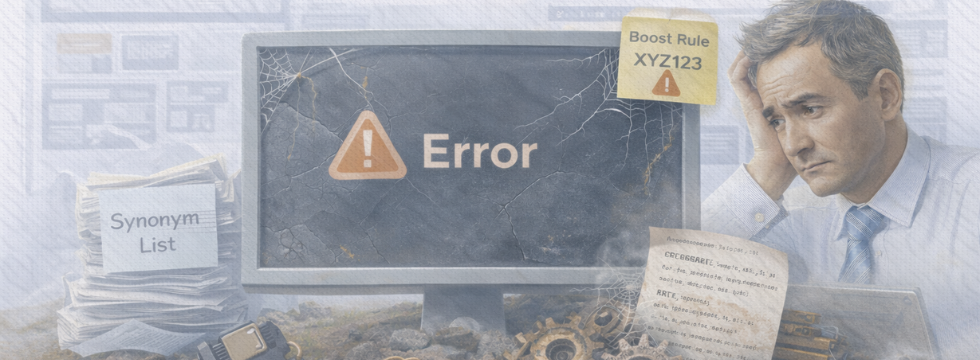

Your ecommerce site search has been accumulating configuration for years. Synonym lists from three product managers ago. Boost rules that made sense before the catalog reorganization. Custom code that nobody remembers writing.

It works—sort of—until it doesn't. And when it breaks, fixing it means archaeology: digging through layers of forgotten decisions, testing changes that might break other things, hoping you don't make it worse.

This is why most B2B companies never upgrade their search. They're afraid to touch it. They know it's not great, but "not great" feels safer than "potentially catastrophic."

So the search stays frozen while buyers' expectations evolve. They use AI-powered tools everywhere else in their lives. Then they come to your site and wonder why it feels like 2015.

Problem #4

We don't give you search software and a login. We build, train, and continuously optimize an AI-powered internal search engine that knows your products as well as your best salesperson—and gets smarter every month without your team lifting a finger.

We ingest your entire product database—titles, descriptions, specifications, categories, PDFs, datasheets. Then we structure it for AI comprehension: normalizing attributes, mapping synonyms, building the relationships between products that make intelligent search possible.

This isn't a one-time upload. As your catalog changes—new products, updated specs, reorganized categories—we update the search intelligence to match. Your internal search engine stays current because we're actively maintaining it."What's your role?" → If they select "Engineer," ask about technical requirements. If they select "Procurement," ask about budget and timeline. If they select "Executive," ask about business objectives.

The result: searches return results based on meaning, not just keyword matching. When a buyer searches for "latex-free exam gloves," they get latex-free exam gloves—even if your product titles say "nitrile" instead of "latex-free."

Your buyers search the way they think. Sometimes that's a part number. Sometimes it's a vague description. Sometimes it's a competitor's SKU pasted from an old purchase order. Our AI understands all of it:

• Typos and misspellings: "parafin" finds paraffin products. "nitrine glovs" finds nitrile gloves. No manual correction needed.

The search interprets intent, not just keywords. Buyers find what they need on the first try.

• Synonyms and jargon: "cover glass" matches "coverslips." "BP cuff" matches "sphygmomanometer." Industry vocabulary works automatically.

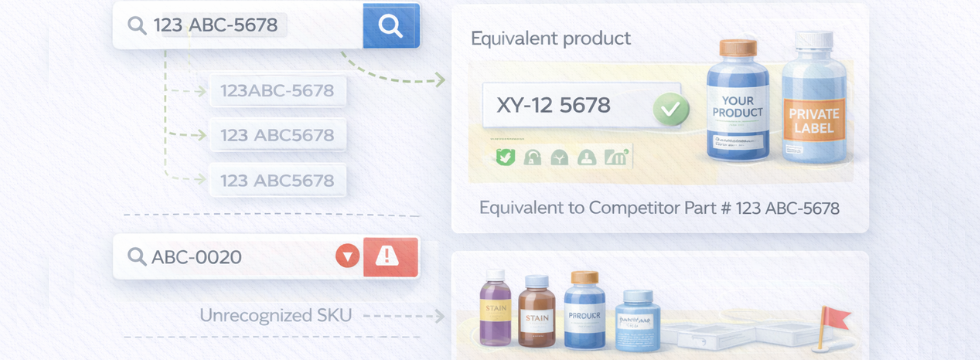

• Competitor part numbers: Buyers paste McKesson, Henry Schein, or Grainger SKUs and see your equivalent products—instantly.

• Specification queries: "5 mil nitrile, blue, case of 1000" returns exactly that configuration, not 847 vaguely related results.

Not all results are equal. The right product should appear first—not buried on page 4 behind accessories, out-of-stock items, or products from categories the buyer didn't ask for. Our ranking engine considers:

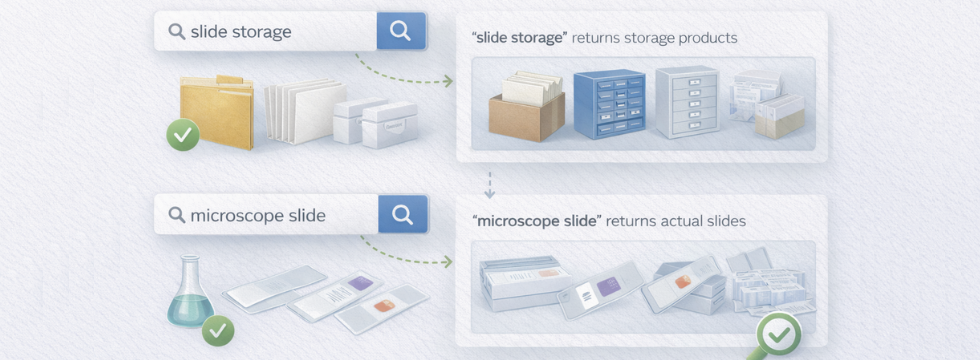

• Query intent: Searching "microscope" returns microscopes, not microscope covers and slides

• Product hierarchy: Main products rank above accessories and consumables

• Stock availability: In-stock items surface above backorders

• Margin optimization: Your private-label and preferred-supplier products appear prominently where they're genuine equivalents

• Context awareness: "slide storage" returns storage products; "microscope slide" returns slides—not storage

Every result set is optimized for conversion, not just relevance.

When a search can't find an exact match, our system doesn't give up. It rescues the query:

• Spelling corrections: "Did you mean 'nitrile exam gloves'?"

• Category suggestions: If the product doesn't exist, recommend related categories

• Clarifying questions: "Are you looking for storage or the product itself?"

• Graceful fallbacks: Never a blank page—always a path forward

Buyers stay on your site instead of bouncing to Google or a competitor.

This is the difference that matters most. We're not selling you software to configure. We're selling you outcomes.

No synonym spreadsheets to maintain. No relevancy rules to tune. No boost weights to adjust. No configuration archaeology when something breaks. We handle:

• Initial catalog analysis and search optimization

• Ongoing query analysis and performance tuning

• Synonym and vocabulary expansion based on real searches

• Ranking adjustments as your catalog and business priorities evolve

• Monthly performance reports showing search conversion and problem areas

Your team focuses on selling. We focus on search.

Algolia, SearchSpring, Klevu, Bloomreach—they all promise powerful search. They all require you to make it work. Here's what that actually means.

You subscribe to an ecommerce site search platform. They give you a dashboard, documentation, and maybe a few hours of onboarding. Then you're on your own.

Now someone on your team needs to:

Configure field weights and boost rules

Build and maintain synonym lists (hundreds of entries)

Set up merchandising rules for promotions

Monitor search analytics and identify problems

Test changes across thousands of product combinations

Fix issues without breaking other searches

Update everything when the catalog changes

This is a specialized job. Most companies assign it to someone who already has a different job—an ecommerce manager, a product data specialist, a developer. They do what they can, which is never enough.

We do the work. All of it.

Pricing that makes sense: Our managed service costs roughly what you'd pay for Algolia or SearchSpring—without requiring a dedicated employee to configure and maintain it. The total cost of ownership is dramatically lower.

For technical stakeholders who want to understand the capabilities powering your internal search engine.

Intelligent typo correction using advanced pattern matching. Generic solution handles all misspellings without manual configuration. "parafin" finds "paraffin" automatically. Smart algorithm prevents false matches ("gloves" won't incorrectly match "glasses"). No synonym entries needed for misspellings.

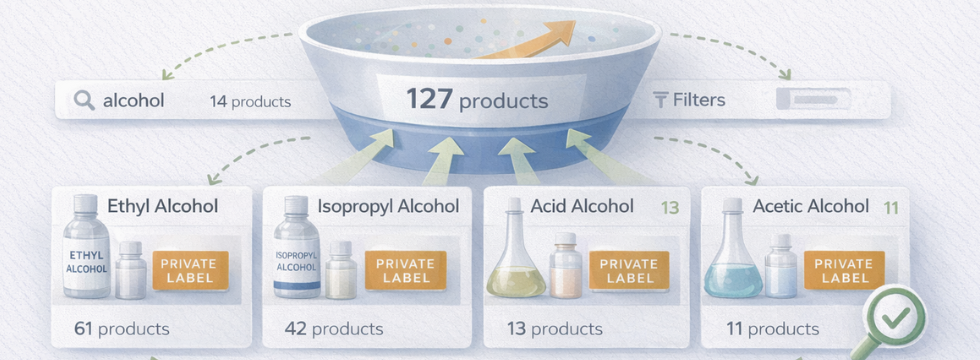

Broad searches automatically expand to include all relevant subcategories. Search "alcohol" returns products from Ethyl Alcohol, Isopropyl Alcohol, Acid Alcohol, and Acetic Alcohol subcategories (127 products instead of 14). Helps buyers discover products across your full catalog and surfaces private-label alternatives in sibling categories.

The search understands the difference between product searches and accessory searches. "slide storage" returns storage products (folders, boxes, cabinets, mailers). "microscope slide" returns actual slides (not storage accessories). Intent detection works automatically without manual rules.

Main products rank above accessories and consumables by default. "microscope" returns actual microscopes first, not microscope covers. "stains" returns stain products, not staining dishes. Matches natural shopping behavior without manual boosting.

Buyers paste competitor part numbers and see your equivalent products. Handles variations in spacing, dashes, and formatting. Can surface private-label alternatives with evidence-based positioning. Exception handling for unrecognized SKUs (flagged for review).

Search understands content from your product PDFs and spec sheets. Technical questions answered from datasheet content. Certification and compliance queries resolved automatically. Source citations maintain buyer trust.

Real scenarios where intelligent internal search engines capture revenue that traditional search loses.

The scenario: A procurement manager needs to find a specific sensor from your 50,000-SKU catalog. They know the application but not your product naming conventions.

They search "temperature sensor industrial -40C." Your search returns 2,300 results sorted alphabetically by manufacturer. They give up after page 2 and call your sales team—or find a competitor with better search.

The search interprets their query as: sensor type = temperature, application = industrial, operating range includes -40°C. Returns 12 matching products, sorted by relevance and availability. The buyer finds the right part in seconds.

The scenario: An engineer is specifying components for a new project. They have a competitor's part number from a reference design they're replacing.

They paste the part number. Your search returns "No results found." They assume you don't carry it and leave.

The competitor SKU resolver identifies the part, returns your equivalent product with spec comparison, and suggests your private-label alternative with equivalent specifications at lower cost.

The scenario: You want to increase private-label adoption, but buyers default to name brands they know.

Your search returns name-brand products first (they've been in the catalog longer, have more reviews, etc.). Private-label products appear on page 2 or 3. Buyers never see them.

Private-label products appear alongside name brands with clear "equivalent specification" positioning when they're genuine alternatives. Buyers see the option, trust the comparison, and increasingly choose the cost-effective alternative. Private-label share grows without aggressive sales tactics.

Metrics from B2B companies that replaced generic site search with managed AI-powered search.

Search-to-click rate

Zero-result searches

Search-initiated conversions

Average results reviewed

Private-label discovery rate

"We used to joke that our site search was a suggestion box—you'd type what you wanted and it would suggest something completely different. Now buyers actually find products. Our search abandonment rate dropped by 60% in the first quarter."

— VP of Digital, Industrial Equipment Distributor

We don't hand you software and disappear. Here's exactly what happens.

Week 1-2

Full export of your product catalog (titles, descriptions, attributes, categories). Analysis of current search performance (top queries, zero-result searches, abandonment patterns). Identification of vocabulary gaps (what buyers search vs. what you call it). Attribute normalization plan for key product categories.

Week 2-3

Catalog ingestion and AI training on your specific products. Attribute extraction and normalization across priority categories. Synonym library construction from industry vocabulary and your query data. Competitor SKU mapping for major alternatives (if applicable).

Week 4-5

Frontend integration with your ecommerce platform. Testing across hundreds of real query patterns. Ranking optimization based on your business priorities. Edge case handling and zero-result rescue flows.

Week 6

Deploy to production with monitoring. Establish performance baselines. Train your team on analytics dashboard (view-only—we handle the tuning). Begin ongoing optimization cycle.

Ongoing

Weekly query analysis and search refinement. Monthly performance reports with specific improvements. Catalog sync as products change. Quarterly business priority reviews.

Right now, someone is on your site searching for a product you sell. They're typing a query that makes perfect sense to them—a competitor's part number, an industry nickname, a specification requirement.

Your current search doesn't understand. It returns 847 results, or zero results, or the wrong results entirely. The buyer leaves. They find a competitor whose search actually works. You never knew they were there.

Every day with a broken internal search engine is another day of buyers who wanted to purchase from you—and couldn't.